Introduction

Why Retirement Savings is Critical in 2025: Highlight the economic conditions, increased life expectancy, and potential impacts of inflation.

Setting Retirement Goals: Discuss why having specific, measurable goals is essential.

Image Suggestion: An image of an elderly couple enjoying retirement, symbolizing financial security.

1. Calculating Your Retirement Savings Goal

How Much Will You Need? Break down retirement calculators, benchmarks like the 4% rule, and why they may need adjustments.

Factors to Consider: Inflation, healthcare costs, desired lifestyle, and debt.

Case Study: Show how a hypothetical person (e.g., 30-year-old aiming to retire by 65) calculates their retirement goal.

Image Suggestion: A graph showing various retirement goals based on lifestyle choices.

2. Types of Retirement Accounts and Their Benefits

401(k) Plans: How employer-sponsored plans work, benefits of tax deferral, and employer matching.

Traditional and Roth IRAs: Pros and cons of each, tax implications, and how to choose.

Health Savings Accounts (HSAs): Explain how they can act as a retirement account due to tax benefits.

Other Plans for Self-Employed Individuals: SEP IRAs, SIMPLE IRAs, and Solo 401(k)s.

Image Suggestion: Comparison chart of different retirement accounts.

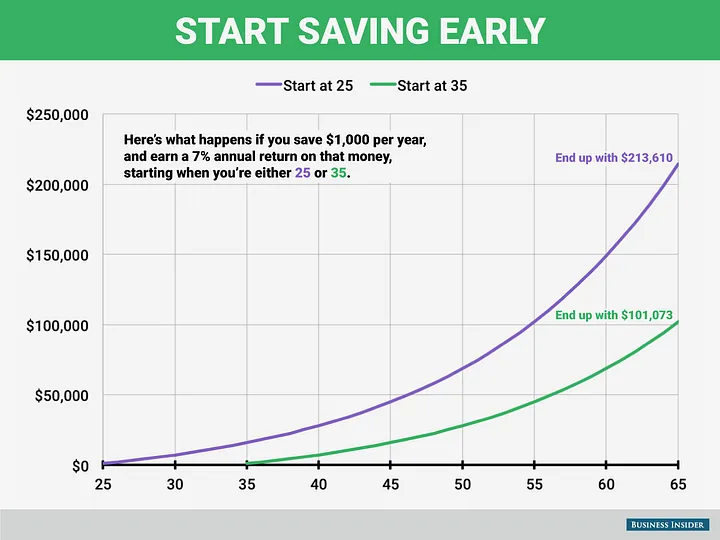

3. Smart Saving Strategies for Every Age

20s–30s: Start Strong: Focus on aggressive savings and compound interest.

40s–50s: Catch-Up Mode: Maximize contributions and start shifting to more conservative investments.

60s and Beyond: Income Preservation: Minimize risks, manage withdrawal strategies, and reduce expenses.

Image Suggestion: A timeline showing retirement-saving strategies by age group.

4. Building an Investment Portfolio for Retirement

Diversifying Your Portfolio: Explain asset allocation across stocks, bonds, mutual funds, and alternative investments.

Choosing Low-Cost Investment Options: How ETFs, index funds, and low-cost mutual funds can be great choices.

Understanding Risk Tolerance: Risk tolerance for each age group and why it matters.

Image Suggestion: Pie chart showing a sample diversified portfolio for retirement.

5. Protecting Against Inflation and Market Volatility

The Impact of Inflation on Retirement Savings: How inflation erodes purchasing power, especially over 20–30 years.

Strategies to Counteract Inflation: Invest in TIPS, dividend-yielding stocks, and inflation-protected funds.

Managing Volatility: Discuss dollar-cost averaging and rebalancing portfolios.

Image Suggestion: Side-by-side chart of inflation rates and the projected impact on savings.

6. Social Security and Medicare: Integrating Benefits into Your Plan

When to Claim Social Security: Explain how delaying benefits can increase monthly payments and how to time your claim.

Medicare Planning: Discuss expected out-of-pocket healthcare costs in retirement and supplemental Medicare options.

Image Suggestion: Social Security and Medicare icons with estimated benefits by age.

7. Retirement Withdrawals: Strategies for Sustainable Income

The 4% Rule: Explain the rule, its assumptions, and why some may adjust it based on the current economy.

Creating an Income Stream: Include Social Security, pensions, annuities, and real estate income.

Tax-Efficient Withdrawals: Strategies for minimizing tax impact by withdrawing from taxable, tax-deferred, and tax-free accounts.

Image Suggestion: Chart of tax-efficient withdrawal strategies.

8. Diversifying Income Sources in Retirement

Real Estate: The pros and cons of rental properties and REITs for steady income.

Side Businesses and Freelance Work: Benefits of working part-time in retirement.

Dividends and Bonds: How they provide steady income and can offset some of the market risks.

Image Suggestion: Image of a rental property or freelance workspace to represent additional income sources.

9. Navigating the Role of Insurance in Retirement Planning

Life Insurance: Why life insurance might be needed, even in retirement.

Long-Term Care Insurance: The importance of planning for healthcare costs, especially if not covered by Medicare.

Disability Insurance: In case of early retirement due to health issues, how disability insurance can support financial stability.

Image Suggestion: Icons of different insurance types (e.g., life, health, disability).

10. Avoiding Common Retirement Planning Mistakes

Underestimating Costs: Healthcare, taxes, and inflation as often-overlooked expenses.

Lack of a Withdrawal Strategy: Describe the risks of drawing too much too soon.

Ignoring Tax Implications: Explain how tax planning can save thousands during retirement.

Image Suggestion: Checklist graphic of common retirement planning mistakes.

11. Adjusting Your Retirement Plan Over Time

Annual Checkups: Why it’s essential to review and adjust your retirement savings strategy every year.

Adapting to Economic Conditions: Staying flexible to adjust for inflation, market trends, and new tax laws.

Working with a Financial Planner: When it may be beneficial to consult a professional.

Image Suggestion: Financial planning software interface or app to show tracking progress over time.

Conclusion (150–200 words)

Summarize Key Takeaways: Emphasize the importance of early saving, diversification, tax efficiency, and ongoing adjustments.

Encourage Action: Inspire readers to evaluate their savings, open a retirement account, or consult with a financial planner if they haven’t started yet.